Silver Bear files amended Mangazeisky Silver Project technical report

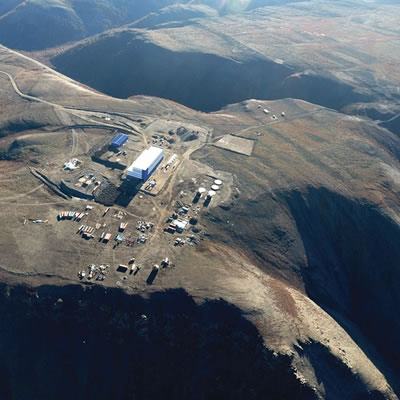

A bird's-eye view of the pit and processing plant at the Mangazeisky Project in Russia. — Photo courtesy Silver Bear Resources TORONTO, Aug. 28, 201

A bird's-eye view of the pit and processing plant at the Mangazeisky Project in Russia. — Photo courtesy Silver Bear Resources

TORONTO, Aug. 28, 2017 (GLOBE NEWSWIRE) -- Silver Bear Resources Plc (“Silver Bear” or the “Company”) (TSX:SBR) announced today that, as a result of a review by the staff of the Ontario Securities Commission (the “OSC”) of its previously filed Mangazeisky North Preliminary Economic Assessment (“M North PEA”), the Company is issuing the following news release regarding our disclosure of the Mangazeisky Project and filing an amended National Instrument NI 43-101 Technical Report on SEDAR (the “Amended Report”).

The OSC review identified that the results of the M North PEA included inferred mineral resources with the results of the previously filed October 2016 Updated Feasibility Study (“Updated FS”). As the Company had determined that M North would be best developed through the integration into the Vertikalny mine plan and not developed as a stand-alone project, the M North PEA in the Amended Report is based on its indicated mineral resources only. In addition, the OSC requested that the Company file only one current technical report to cover all aspects of the Mangazeisky Project. The newly filed technical report meets this requirement, presenting the M North PEA as an alternative development case in section 24 of the Technical Report filed today and is available on SEDAR (www.sedar.com).

Although not required by the OSC, the Company and Tetra Tech thought it prudent to further update its October 2016 Updated FS, beyond the amendments requested by the OSC, in order to ensure that the Amended Report is current. Below is a summary of the amendments to the M North PEA and the results of the 2017 Updated FS, which are now both included in the Amended Report.

Mangazeisky Project Update in the Amended Report

Upon inspection, it was clear that the M North deposit contains a large enough indicated mineral resource at a sufficient average silver grade (770 g/t Ag) to warrant an economic analysis of its potential. Although the scale of the deposit did not allow it to carry significant capital costs, its proximity to the Vertikalny mine site, being within 6 kilometres, made it ideal as a satellite deposit that could be mined by the same equipment and processed using the same plant as the Vertikalny operation. The following summarizes the changes to the M North PEA now detailed in section 24 of the Amended Report:

- In the updated M North PEA the inferred material (127 kt grading 560 g/t Ag and containing 2.3 Moz Ag) is treated as waste and given zero value in the pit optimization, mine schedule and financial modelling. As such, the M North mineral resource planned extraction changed from 387 kt at an average grade of 531 g/t Ag to 193 kt at a substantially increased average grade of 675 g/t Ag.

- The pre-tax NPV at a 5% discount of the M North economic opportunity and the potential economic value to the overall Mangazeisky Silver Project, which would occur if its indicated mineral resources were integrated into the Vertikalny mine plan, changed to US$103 million from US$158 million. The post-tax NPV at a 5% discount is US$87 million.

- The payback of M North deposit is now 1.9 years, changed from 1.4 years.

The M North PEA is preliminary in nature and should not be considered a pre-feasibility or feasibility study, as the economics and technical viability of the Project have not been demonstrated at this time. There is no certainty that the M North PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability, and as such there is no certainty that the preliminary assessment and economics will be realized.

Updated Vertikalny FS Highlights

The following are the economic highlights from the 2017 Updated FS for Vertikalny that forms part of the Amended Report and that takes into consideration the effects on the capital costs of the previously announced delay in production start-up and the changes to the detailed mine plan due to the advancement of construction. Assumptions remain the same with a life-of-mine (“LOM”) weighted average silver price of US$19.76/oz and an exchange rate of RUB66.00/USD. The Vertikalny deposit mineral resource statement remains as of July 8, 2016. The following summarizes the highlights of the changes in the 2017 Updated FS:

- Initial capital costs increased from US$50 million to US$65 million, with sustaining capital costs increasing 13% to US$17 million. Increases are predominately the result of capitalizing certain operating costs, such as winter road supply, which has been classified as a capital cost due to production delay and changes to mine plan.

- The pre-tax NPV at a 5% discount is US$88 million; the pre-tax IRR is 48.2% and the payback period is now 1.9 years.

- With Far East tax incentives, the post-tax NPV at a 5% discount is US$77 million; the post-tax IRR is 44.3% and the payback period is now 2 years.

- Without Far East tax incentives, the post-tax NPV at a 5% discount is US$46 million; the post-tax IRR is 28.4% and the payback period is now 2.4 years.

- Total proven and probable mineral reserves of 858 kt grading 809 g/t Ag and containing 22.3 million troy ounces of silver.

- The processing operating costs for oxide ore increased from $48/t to $52/t; processing recovery decreased from 85% to 78%.

Graham Hill, President and Chief Executive Officer, commented: “As we announced at the end of January this year, it had become necessary to review our production plans to the end of 2017. The revised construction and commissioning plans for 2017 and the progress with the permitting process have generally proceeded in line with revised 2017 plans and the team is looking positively to the future start of production.”

Mr. Hill continued: “The Amended Report gave us an opportunity to update the Vertikalny FS to reflect the changes in timing of the start of production as well as other changes driven principally by the delay in the start of production. The Vertikalny feasibility study in the Amended Report confirms that the Project has very positive financial outcomes for the Company. It is important to note that the Project is significantly advanced with construction, mining and commissioning works well underway; the numbers in the Amended Report thus accurately portray the reality of the project in the challenging environment in which the team has achieved so much. Although it is noted that some of this work has been undertaken whilst in the process of obtaining regulatory approvals, a number of regulatory approvals are still required to be obtained and the failure to obtain them could cause delays in development. In addition, as discussed in section 24 of the Amended Report, the M North deposit offers an opportunity to further improve overall mine economics, increase the overall mine life and extend the useful life of the capital equipment on the Mangazeisky project. We believe we are leading the emergence of silver mining in this part of Russia and see significant opportunities ahead as we look to bring our first mine into production.”

Qualified Persons

The effective date of the Amended Report is August 20, 2017, the effective date of the Vertikalny mineral resource estimate is July 8, 2016 and the effective date of the M North mineral resource estimate is October 19, 2016.

About Silver Bear

Silver Bear (TSX:SBR) is focused on the development of its wholly-owned Mangazeisky Silver Project, covering a licence area of approximately 570 km2 that includes the high-grade Vertikalny deposit (amongst the highest- grade silver deposits in the world), located 400 km north of Yakutsk in the Republic of Sakha within the Russian Federation. The Company was granted a 20-year mining licence for the Vertikalny deposit in September 2013 and announced an updated Feasibility Study in October 2016. Project construction and permitting is advancing with first silver production targeted for Q4 2017. Other information relating to Silver Bear is available on SEDAR at www.sedar.com as well as on the Company's website at www.silverbearresources.com.