NOVAGOLD Reports Second Quarter Results: Donlin Gold Final Environmental Impact Study Published

NOVAGOLD is a well-financed precious metals company focused on the permitting and development of its 50%-owned Donlin Gold project in Alaska. — Photo

NOVAGOLD is a well-financed precious metals company focused on the permitting and development of its 50%-owned Donlin Gold project in Alaska. — Photo courtesy Donlin Gold

NOVAGOLD RESOURCES INC. (NYSE American:NG) (TSX:NG) today released its 2018 second quarter financial results and updates for its flagship Donlin Gold project in Alaska, which NOVAGOLD owns equally with Barrick Gold Corporation (“Barrick”), and its Galore Creek copper-gold-silver project in British Columbia, which NOVAGOLD owns equally with Teck Resources Limited (“Teck”).

Details of the financial results for the second quarter ended May 31, 2018 are presented in the consolidated financial statements and quarterly report filed on Form 10-Q with the SEC that is available on the Company's website at www.novagold.com, on SEDAR at www.sedar.com, and on EDGAR at www.sec.gov. All amounts are in U.S. dollars unless otherwise stated and all resource and reserve estimates are shown on a 100% project basis.

During the second quarter 2018 and to date, NOVAGOLD achieved the following milestones:

Donlin Gold permits, required for commencement of site activities, are nearing completion:

- The Corps completed and published the final EIS, along with a Notice of Availability in the Federal Register. The final EIS is available on the Donlin Gold EIS website: www.donlingoldeis.com

- The Alaska Pollutant Discharge Elimination System (APDES) Wastewater Discharge permit was issued on May 24, 2018

- The Corps and Bureau of Land Management (BLM) are expected to issue a single Federal Record of Decision (ROD) for the project in the second half of 2018

- The Pipeline and Hazardous Materials Safety Administration (PHMSA) issued the Special Permit for the natural gas pipeline on June 5, 2018

- Other key state and federal permits and approvals are scheduled to be finalized concurrently with or shortly after the ROD in 2018

NOVAGOLD and Barrick are advancing the optimization work aimed at improving capital efficiencies and enhancing Donlin Gold’s project execution plan while maintaining upside potential and collecting the information that will be needed to update the 2011 feasibility study

Community outreach efforts continued in Alaska:

- NOVAGOLD and Donlin Gold staff visited several villages with representatives of the Calista Corporation and The Kuskokwim Corporation (TKC) across the Yukon-Kuskokwim (Y-K) region to meet with traditional village councils, residents and students

- Participated in the Y-K Comprehensive Economic Development Strategy meeting and Bethel Job Center Career Fair

- Sponsored and participated in Clean Up Green Up efforts in the Y-K region

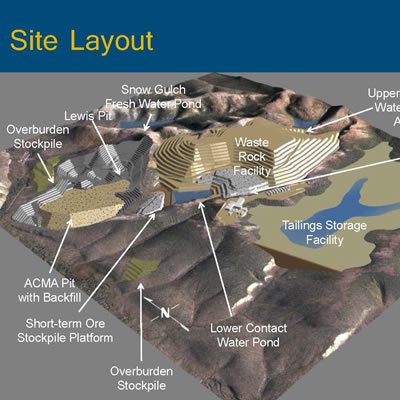

Donlin Gold Project

During the second quarter of 2018, our focus was twofold: firstly, to support the Corps in completing the Donlin Gold final EIS along with federal and state permitting authorities in advancing other required permits, and secondly, together with our partner Barrick, to advance Donlin Gold technical evaluations and incorporate results from our latest drill program. We continue to concentrate our efforts on improving capital efficiencies and the overall project execution plan while maintaining the upside potential of the project. Our plan is to provide an update on our progress in the fourth quarter.

We have come a long way since 2012 when we embarked on a complex path of securing the key state and federal permits which we need to proceed with site activities at Donlin Gold. At the same time, we have continued to provide support to all the agencies as they advanced permitting activities, identified and analyzed a range of proposed development alternatives, as well as prepared the environmental analysis of the proposed action and reasonable alternatives. The final step of the federal process is filing of the ROD, which we expect to occur in the second half of 2018. The ROD will include the Corps’ decision on issuing the Clean Water Act Section 404 and River and Harbors Act Section 10 permit and the BLM’s decision on the right-of-way (ROW) application. The Corps will prepare a detailed evaluation documenting why the permitted project represents the least environmentally damaging practicable alternative compared to other project options reviewed. The BLM will document its decision on issuing the ROW authorization for the portions of the proposed Donlin Gold pipeline on BLM lands. The collaboration between the Corps and BLM on the single ROD will simplify and bring greater clarity to the permitting decisions.

We have made excellent progress on other federal actions with PHMSA issuing the Special Permit for the natural gas pipeline on June 5, 2018. In addition, with our support, the Corps is finalizing other federal consultations under the National Historic Preservation Act, Endangered Species Act, and Magnuson-Stevens Fishery Conservation and Management Act.

Further to our receipt of the Donlin Gold air quality permit last year, we have now obtained the final APDES wastewater discharge permit, which was issued on May 24, 2018. The draft integrated waste management permit has been published with plans for issuance of the final permit in the coming months. Other key state and federal permits and approvals are scheduled to be finalized concurrently with or shortly after the ROD.

Our engagement efforts with a broad stakeholder base are the foundation for all our activities. We were delighted to see this highlighted in a recent press release by the State of Alaska where Governor Walker stated his support for Donlin Gold and its “proven … commitment to engage local stakeholders and make sure all development is responsible.” We were equally gratified by the letters of support for the Donlin Gold final EIS that were submitted by Calista Corporation (Calista) and The Kuskokwim Corporation (TKC), our Native Corporation partners and owners of the mineral and surface rights, respectively.

“Donlin Gold proposes to build a gold mine in partnership with Calista and TKC that would allow us to realize for our Alaska Native shareholders the value of the minerals in our subsurface estate, in conformance with ANCSA’s (Alaska Native Claim Settlement Act) mandate.” — Andrew Guy, President & CEO of Calista

“Developing that land is part of the novel system that Congress structured under ANCSA for Alaska Native corporations to provide self-sustaining benefits for their shareholders. To realize that promise, Alaska Native corporations must be able to develop the mineral resources within the lands they selected under ANCSA …. TKC is confident that the Donlin Gold project will meet the permitting requirements after nearly two decades of analysis and six years under the EIS and 404 processes.” — Maver Carey, TKC’s President & CEO

Our goal is to contribute our technical expertise to support Calista and TKC as they realize ANCSA’s objectives of securing Alaska Native self-determination through responsible development of the natural resources they selected under ANCSA.

The Donlin Gold project optimization work, carried out by experienced technical teams from NOVAGOLD and Barrick as well as a third-party engineering firm, is advancing as planned. The owners have studied opportunities to improve capital efficiencies, integrated the results from the 2017 drill program into the geologic and resource model, and evaluated enhancements to the project’s execution plan without jeopardizing the project’s upside potential. To date, these additional studies have identified opportunities to use more selective mining that could improve feed grade. They have also identified innovative technologies in logistics and automation, modular construction techniques to improve efficiencies, and third-party participation for infrastructure development. These opportunities have the potential to benefit the project when the owners proceed to update the Donlin Gold feasibility study and initiate the engineering work necessary to advance the project design from feasibility level to basic, and then detailed engineering. We expect to provide an update on our progress and the next steps in this program after the receipt of the ROD. Barrick and NOVAGOLD will take all this work into account before reaching a construction decision and remain committed to advancing the Donlin Gold project in a financially disciplined manner with a strong focus on environmental stewardship and social responsibility.

Donlin Gold continues to occupy a unique position in our industry, and we continue to believe that it has the potential to emerge as one of the largest future pure gold producing mines in the world located in one of the safest jurisdictions in the world. Being America’s second largest gold-producing state, Alaska is a place where environmentally and socially responsible resource development is strongly supported. The benefits inherent in Donlin Gold’s projected 27-year mine life are of generational significance to the state. With approximately 39 million ounces of gold in the measured and indicated resource categories grading 2.24 grams per tonne1, Donlin Gold is almost four times the size of the peer group average and nearly double the world average grade2. Its exploration potential, as evidenced by the planned pits occupying only three kilometers of an eight-kilometer mineralized belt, is exceptional. These project attributes converge in Donlin Gold at a time when no large discoveries have been made in years, average grades continue to fall, and resource nationalism is reaching levels that make mine development very difficult in many resource-based countries of Africa, Asia and South America.

Galore Creek Project

In the second quarter, the Galore Creek Mining Corporation (GCMC) completed its resource data base consolidation and optimization. Mobilization of the camp for the summer care and maintenance program and asset preservation work began with a week-long safety orientation program. In many respects, Galore Creek is similar to the Donlin Gold project with size, scale, quality, longevity, exploration potential, jurisdictional appeal and equal ownership by NOVAGOLD and Teck, a major mining company. However, since our mantra is to focus on advancing our flagship property Donlin Gold, we remain committed to our objective to sell all or part of our 50% interest in Galore Creek to strengthen our balance sheet and to support continued development of the Donlin Gold project. Jurisdictional risk is even more prominent in copper and Galore Creek is among the few large-scale development assets located in North America.

Stakeholder Engagement

The outreach efforts with Calista and TKC in the broader Y-K region are an important and essential element of our day-to-day activities. As such, on an ongoing basis many events, presentations, collaborations and workshops take place that contribute toward open and frequent engagement with the local communities. In the second quarter, NOVAGOLD participated in several community activities with Donlin Gold. Some of the highlights included the Bethel Job Center Career Fair and the Alaska Miners Association conference; presentations at gatherings and conferences throughout the State of Alaska; a project open house in Bethel; village and stakeholder meetings throughout the Y-K region; the collection of lost and found material from local schools in preparation for the Donlin Gold Annual Clothing Extravaganza; the Y-K Comprehensive Economic Development Strategy meeting; and annual Clean Up Green Up initiative in the Y-K region. Ahead of our annual general meeting of shareholders in early May, we engaged with shareholders representing 82% of the Company’s issued and outstanding shares. Our active shareholder engagement program continues to be a high priority and is an integral part of our corporate governance practices. Regardless of financial need, market trends or economic conditions, NOVAGOLD is committed to investor engagement to update and listen to existing shareholders, as well as attract new investors who, we believe, have an opportunity to invest in a vehicle that has the best, substantially de-risked, high quality large-scale projects in North America.

Balance Sheet

We remain financially strong with approximately $70 million in cash and term deposits as of May 31, 2018, representing a healthy cash position that enables the Company to execute on its stated strategy of enhancing the value of the Donlin Gold and Galore Creek projects. The Company has sufficient funds to complete permitting and planned project optimization work at Donlin Gold, as well as meet our other financial obligations.

As always, we thank our partners at Barrick and Teck for their exceptional professionalism and commonality of purpose. We also thank Calista and TKC, our Native Corporation partners in Alaska, as well as the Tahltan First Nation, our partner in British Columbia for their active engagement and support, as they are a key cornerstone of our progress. Many thanks to all the government professionals at the state, provincial and federal agencies where an enormous amount of detailed work takes place. And finally, many thanks to our Board for its steady leadership, our employees for their hard work, and our shareholders for their strong support and trust in what we are doing.

Gregory A. Lang

President & CEO

Liquidity and Capital Resources

Cash used in operating activities increased by $0.3 million in the second quarter 2018 due to increased general and administrative expense and changes in working capital. Cash used to fund Donlin Gold and Galore Creek was $1.5 million higher than the prior year quarter due to ongoing optimization efforts at Donlin Gold. Cash provided from term deposits was $4.1 million lower than in the prior year quarter.

For the first six months of fiscal year 2018, cash used in operating activities increased by $0.7 million, primarily due to increased general and administrative expense and changes in working capital. Cash used to fund Donlin Gold and Galore Creek was $1.2 million higher than the prior year period. Cash provided from term deposits was $0.9 million higher than the prior year period. No cash was used in financing activities in the first six months of 2018.

NOVAGOLD’s cash and term deposits are sufficient to cover the anticipated funding at the Donlin Gold and Galore Creek projects in addition to general and administrative costs through completion of permitting at the Donlin Gold project. The term deposits are denominated in U.S. dollars and held at Canadian chartered banks.

2018 Outlook

NOVAGOLD continues to anticipate a total budget for the year of approximately $28 million, comprised of $14 million to fund our share of expenditures at the Donlin Gold project, $3 million at the Galore Creek project, and $11 million for general and administrative costs.

NOVAGOLD remains focused on four primary goals in 2018: advance the Donlin Gold project toward a construction/ production decision; maintain a favorable reputation of the Company and its projects among shareholders, Native entities and other stakeholders; promote a strong safety culture maintaining a zero lost-time accident record at all project and office locations; and safeguard the treasury.

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company focused on the permitting and development of its 50%-owned Donlin Gold project in Alaska, one of the safest mining jurisdictions in the world. With approximately 39 million ounces of gold in the measured and indicated resource categories (541 million tonnes at an average grade of approximately 2.24 grams per tonne) 3, inclusive of proven and probable reserves, Donlin Gold is regarded to be one of the largest, highest grade, and most prospective known gold deposits in the world. According to the Second Updated Feasibility Study (as defined below), once in production, Donlin Gold is expected to produce an average of more than one million ounces per year over a 27-year mine life on a 100% basis. The Donlin Gold project has substantial exploration potential beyond the designed footprint which currently covers only three kilometers of an approximately eight-kilometer long gold-bearing trend. Current activities at Donlin Gold are focused on permitting, optimization work, community outreach and workforce development in preparation for the construction and operation of this top tier asset. NOVAGOLD also owns 50% of the Galore Creek copper-gold-silver project located in northern British Columbia. According to the 2011 Pre-Feasibility Study (as defined below), once in production, Galore Creek is expected to be the largest copper mine in Canada, a tier-one mining jurisdiction. NOVAGOLD anticipates selling all or a portion of its interest in Galore Creek and would apply the proceeds toward the development of Donlin Gold. With a strong balance sheet, NOVAGOLD is well positioned to stay the course and take Donlin Gold through permitting.