The European Battery Alliance is Moving up a Gear

French battery cell manufacturer Saft and Opel, the German subsidiary of automaker PSA Group, are finalising the details of a major investment project in battery cell manufacturing. Is the European Union (EU) finally challenging Asia’s dominance on battery cells production? What chances of success for the European Battery Alliance (EBA) and what implications for the EU industrial policy?

Back in 2017, the European Commission (EC) warned about the serious risk for Europe to become irreversibly dependent on battery cells imports, for both the roll-out of clean mobility and the stabilization of power grids integrating high shares of variable renewable energy sources. Electrically-chargeable vehicles (EVs) still account for only 2% of new cars registered across the EU throughout 2018, but the year-on-year growth rate hit 38.2% and this trend is pitched to continue with the recent agreement on ambitious 2025 and 2030 CO2 emission targets for new cars and vans. Likewise, expected shifts in national electricity mixes, including the German coal phase out, will create substantial flexibility needs and thus strong market opportunities for stationary battery storage.

All conditions are in place for demand to flourish, and yet the value chain risks being mostly non-European, in particular when it comes to battery cells manufacturing. Cells are a strategic component, accounting for about 70% of the costs of the battery pack, which makes up about 35% of the costs of a fully-electrified vehicle. This segment is currently dominated by East-Asian competitors, with Panasonic (Japan) and LG Chem (South Korea) being top manufacturers for the automotive market, closely followed by Samsung SDI (South Korea), CATL (China) and SK Innovation (South Korea).

- Today, European automakers are fully dependant on Asian manufacturers for battery cells, a strategic component accounting for 70% of the total battery cost. This is a risky bet: if automakers have no guarantee on a stable supply of high-performing cells, they may lose the battle over electric vehicles.

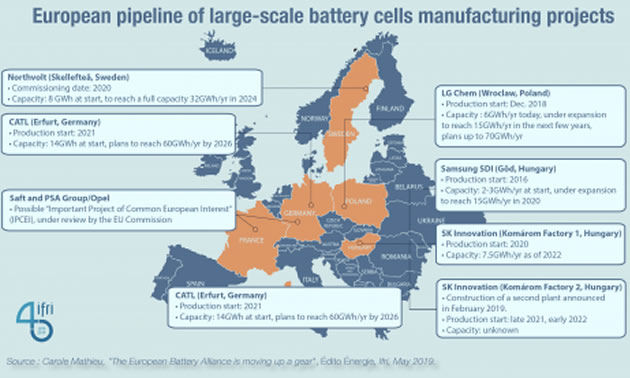

- To minimise transport costs and control the quality of cells, automakers have first requested the Asian incumbents to build gigafactories in Europe, close to the decision centres of the EU automotive industry. A shift in strategy is now under way: European automakers are strengthening their competence in electro-chemistry and they are looking for a more direct involvement in battery cell manufacturing, as with the PSA/Opel & Saft project.

- EU battery cells needs could well reach 500 GWh/yr by 2030, or the equivalent of about 10 gigafactories of the size of the Tesla-Panasonic one in Nevada. More than an "Airbus for batteries", Europe needs several industrial consortia, involving European and non-European stakeholders. With international partnerships, the EU has a chance to acquire to the know-how and progressively catch up with market leaders.

- The European battery industry should be globally-integrated, but it should also be a frontrunner in terms of socio-environmental performance. The EU must introduce sustainability requirements on the production phase and promote commitments on ethical sourcing of raw materials and critical metals in particular.

- It is also important to acknowledge that EU's efforts will never match China's ambitions (half of the global EV market). To build a prosperous EU battery and EV industry, the EU must step up efforts to remove barriers to the Chinese market.